Renters Insurance in and around Las Vegas

Welcome, home & apartment renters of Las Vegas!

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Calling All Las Vegas Renters!

No matter what you're considering as you rent a home - price, number of bathrooms, number of bedrooms, apartment or condo - getting the right insurance can be crucial in the event of the unexpected.

Welcome, home & apartment renters of Las Vegas!

Coverage for what's yours, in your rented home

There's No Place Like Home

When the unpredicted tornado happens to your rented townhome or condo, usually it affects your personal belongings, such as a bicycle, a cooking set or a tablet. That's where your renters insurance comes in. State Farm agent Mario Giannini is dedicated to help you examine your needs so that you can keep your things safe.

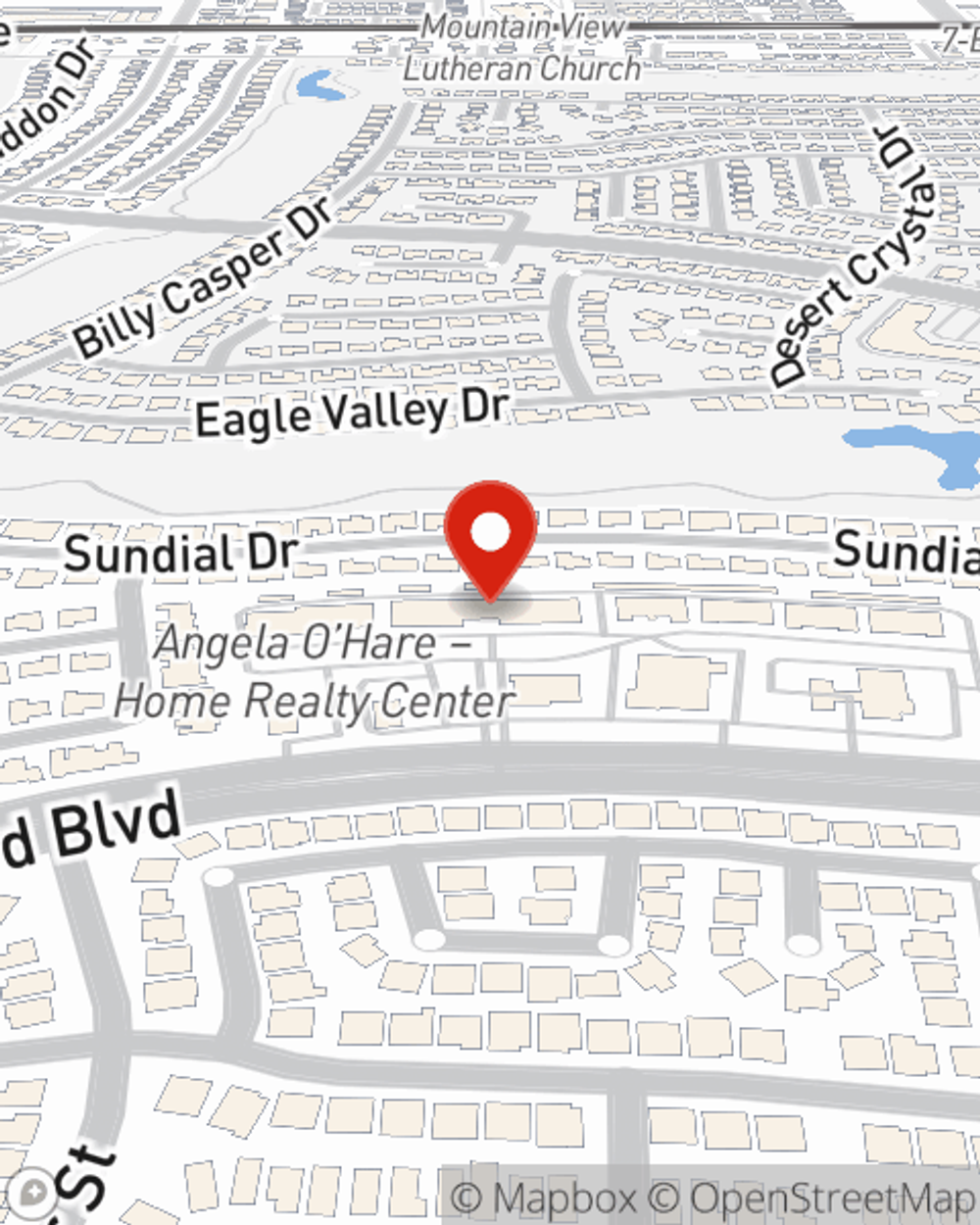

Renters of Las Vegas, State Farm is here for all your insurance needs. Contact agent Mario Giannini's office to learn more about choosing the right savings options for your rented space.

Have More Questions About Renters Insurance?

Call Mario at (702) 982-3300 or visit our FAQ page.

Simple Insights®

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Mario Giannini

State Farm® Insurance AgentSimple Insights®

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.